Child Tax Credit 2024 Qualifications Income – The child tax credit and other family tax credits and deductions can have a significant impact on your tax liability and potential refund. However, the qualifications and amounts f . Had or adopted a child in 2023? What new parents need to know about tax credits and deductions. Importantly, the enhanced Child Tax Credit went away in 2022. .

Child Tax Credit 2024 Qualifications Income

Source : www.cpapracticeadvisor.com

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

Earned Income Tax Credit 2024 Eligibility, Amount & How to claim

Source : www.bscnursing2022.com

Child Tax Credit 2024 Income Limits: What is the income limits for

Source : www.marca.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Child Tax Credit 2024: Will there be a Child Tax Credit in 2024

Source : www.marca.com

IRS Child Tax Credit 2024: Credit Amount, Payment Schedule, Tax Return

Source : kvguruji.com

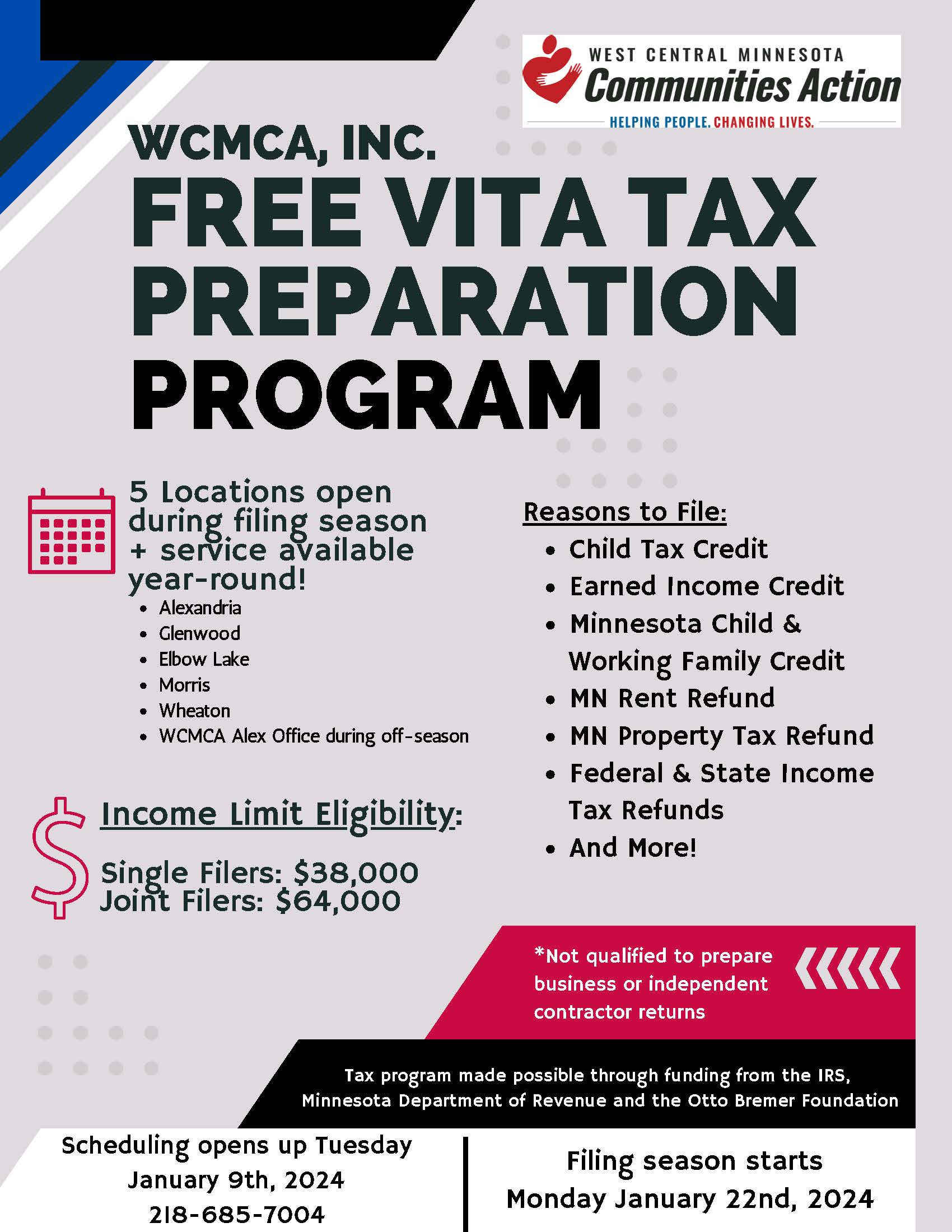

Free Tax Preparation West Central Minnesota Communities Action, Inc.

Source : wcmca.org

Maximum Earned Income Tax Credit for 2024 #eitc #credit #irs #2024

Source : www.tiktok.com

2024 Federal EV Tax Credit Information & FAQs Plug In America

Source : pluginamerica.org

Child Tax Credit 2024 Qualifications Income IRS Issues Table for Calculating Premium Tax Credit for 2024 CPA : The new proposed child tax credit would be more modest than the pandemic-era one passed in the American Rescue Plan, though The Center on Budget and Policy Priorities says that the expansion would . You may qualify for a slew of new tax credits and deductions depending on your income level or guardian who is filing taxes in 2024. For your child or dependent to qualify, they must .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)